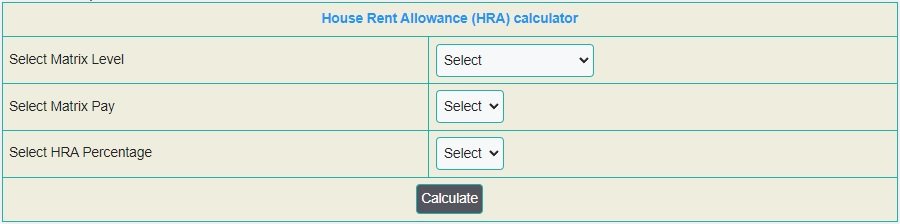

HRA Online Calculator 2023 after 7th CPC

HRA is a common feature in Indian salary packages which assists employees in paying their rent expenses. It is free from taxes up to a certain limit and is therefore an appealing aspect of the salary structure. The total amount of HRA depends on factors such as the employee’s salary, place of residence, and the specific rental rate. In India, the HRA is calculated based on a percentage of the employee’s basic pay which varies depending on the city, with higher percentages offered to those living in metropolitan areas.

The actual amount of HRA given is determined by the actual rental amount paid, which cannot exceed the HRA percentage of the basic salary. To be eligible for HRA, it is necessary for employees to live in rented residential properties and provide evidence of rental payments to their employer.

What is the meaning of HRA?

Companies offer their staff a housing rent allowance (HRA) as an element of their remuneration to support the costs of rental accommodation. To be eligible for an HRA exemption, individuals must reside in a rented property. The exemption for HRA is covered under Section 10(13A) and Rule 2A of the Income Tax Act, 1961.

What is House Rent Allowance in Salary?

The HRA serves as an employee benefit intended to assist in covering the living expenses of employees working in a given city. While it is regarded as a component of an individual’s salary, there exists some provision of the IT Act of 1961, namely Section 10 (13A), which allows for a portion of the HRA to be tax-exempt depending on certain criteria being fulfilled. The amount of the HRA given to employees is determined by their employers who use factors such as compensation level, salary structure, and residential city. To ensure that you receive the maximum tax benefits allowed under Income Tax regulations, it is recommended that you have a conversation with your employer.

What is the current rates of HRA?

The HRA rates could change depending on the percentage of Dearness Allowance (DA). According to the proposal by the 6th Central Pay Commission, individuals residing in Class X cities qualify for 30% of basic pay plus grade pay, military service pay, and NPA. For those in Class Y and Z cities, the percentage is 20% and 10%, respectively. However, if the DA exceeds 25%, the HRA rates would be modified to 27%, 18%, and 9% for X, Y, and Z classes of cities. When the DA exceeds 50%, further adjustments will be made to restore the rates back to 30%, 20%, and 10%.

What are the benefits of HRA for Govt Employees?

The House Rent Allowance (HRA), an essential element of Central Government employees’ compensation package, covers costs related to rental housing. HRA rates are segmented into three groups – X, Y, and Z – based on city classification. On July 1st, 2021, HRA rates were updated to 9%, 18%, and 27% for corresponding cities in Group Z, Y, and X, respectively. Employers deduct a portion of an employee’s basic salary to provide this allowance, which is determined by the employee’s location. Calculating HRA within the salary is a simple procedure. If an employee’s basic salary is Rs. 49,000, depending on their city of residence, they will receive an HRA of Rs. 13,230 (27%), Rs. 8,820 (18%), or Rs. 4,410 (9%).

When will increase HRA to 30 percent?

The House Rent Allowance (HRA) for Central Government employees was recently revised on July 1, 2021. Another revision is set to take place in 2024 when the dearness allowance (DA) percentage reaches 50%. In the event that the DA increase reaches 50%, the HRA will be increased from 27% to 30%. A memorandum from the Department of Personnel and Training stated that the HRA will be adjusted to 30%, 20%, and 10% respectively when the DA surpasses 50%. Furthermore, the HRA will be raised to 27%, 18%, and 9% of Basic Pay in X, Y, and Z cities when the DA exceeds 25%. Finally, the rates in these cities will increase to 30%, 20%, and 10% of Basic Pay when the DA reaches 50%.

Related Topics:

- Cabinet approves 4% DA to CG Employees and pensioners from Jan 2023

- TN CM MK Stalin Announces 4% DA Hike for TN Govt Employees and Teachers from 1.1.2023

- DA/DR from January 2023 at 42% is Confirmed

What is the minimum rate of HRA?

The new minimum HRA rates are set to benefit more than 700,000 employees. The rates vary according to the city classification: X-class cities will receive a minimum of Rs. 5400, Y-class cities a minimum of Rs. 3600, and Z-class cities a minimum of Rs. 1800. It’s important to mention that the minimum HRA amount is now Rs. 1800, which is equivalent to 10% of the minimum basic pay.

Classification of Cities for HRA after 7th CPC

After the 7th Pay Commission, cities in India are classified into three categories, namely X Cities, Y Cities, and Z Cities, based on their population. X and Y class cities and towns are eligible for 24% and 16% HRA respectively, while other cities belong to the Z class. You can find a State-wise list of X, Y and Z class cities in the table below.

Hyderabad is classified as an X city with a 24% HRA in Andhra Pradesh and Telangana, while Vijayawada, Warangal, Greater Visakhapatnam, Guntur and Nellore are Y cities with a 16% HRA. Patna is the only Y city in Bihar while Guwahati is the only Y city in Assam.

Chandigarh and S.A.S. Nagar, Mohali are the only two cities in Chandigarh, both of which belong to the Y class with a 16% HRA. Durg-Bhilai Nagar and Raipur are the two Y cities in Chhattisgarh. Delhi is the only X city in Delhi with a 24% HRA, while Ahmedabad is the only X city in Gujarat. Other cities such as Rajkot, Jamnagar, Bhavnagar, Vadodara, and Surat fall under Y cities with a 16% HRA. Faridabad and Gurgaon are Y cities with a 16% HRA in Haryana.

Jammu & Kashmir has Srinagar and Jammu as Y cities with a 16% HRA, while Jamshedpur, Dhanbad, Ranchi, and Bokaro Steel City are Y cities in Jharkhand. Karnataka has Bangalore/Bengaluru as an X city with a 24% HRA. Belgaum, Hubli-Dharwad, Mangalore, Mysore, and Gulbarga are Y cities with a 16% HRA. Kozhikode, Kochi, Thiruvananthapuram, Thrissur, Malappuram, Kannur, and Kollam are Y cities in Kerala.

Madhya Pradesh has Gwalior, Indore, Bhopal, Jabalpur, and Ujjain as Y cities. In Maharashtra, Greater Mumbai and Pune are the only X cities, while other cities such as Amravati, Nagpur, Aurangabad, Nashik, Bhiwandi, Solapur, Kolhapur, Vasai–Virar City, Malegaon, Nanded-Vaghela, and Sangli belong to the Y class with a 16% HRA.

Cuttack, Bhubaneswar, and Raurkela are Y cities in Odisha, while Pondicherry is a Y city in Puducherry. Punjab has Amritsar, Jalandhar, and Ludhiana as Y cities, while Rajasthan has Bikaner, Jaipur, Jodhpur, Kota, and Ajmer as Y cities. In Tamil Nadu, Chennai is the only X city, while Salem, Tiruppur, Coimbatore, Tiruchirappalli, Madurai, and Erode are Y cities with a 16% HRA.

In Uttar Pradesh, Moradabad, Meerut, Ghaziabad, Aligarh, Agra, Bareilly, Lucknow, Kanpur, Allahabad, Gorakhpur, Varanasi, Saharanpur, Noida, Firozabad, and Jhansi belong to the Y class. Dehradun is the only Y city in Uttarakhand, while Kolkata is the only X city in West Bengal. Other cities such as Asansol, Siliguri, and Durgapur are Y cities with a 16% HRA. Note that Saharanpur was classified as a Y class city from June 2011.

HRA Exemption from Income Tax

Discover how to compute HRA exemption from Income Tax: If you’re employed and seeking to get an exemption from Income Tax on your House Rent Allowance (HRA), this is for you. Lucky for you, under Income Tax Rules 10(13A) and Rule 2A, you can claim exemption on the minimum of the following:

– The actual HRA obtained in your salary

– 40% of your salary (Basic Pay + DA) for Non-Metros

– 50% of your salary (Basic Pay + DA) for Metros such as Mumbai, Calcutta, Delhi, or Chennai

– Rent paid minus 10% of your salary

At the same time, if you’re living in your own house or not paying any rent, you won’t be eligible for the HRA exemption. Rest assured though, our HRA Exemption Calculator can determine the precise amount of exemption that you can claim. Therefore, use our calculator and experience a tax-free income with HRA exemption.

7th Pay Commission New HRA Table

HRA Rates for Pay Matrix Level 1

| 7th Pay Commission Pay Matrix Level 1 (Grade Pay 1800) | ||||

| Index | Basic Pay | HRA 8% (Z Class Cities) | HRA 16% (Y Class Cities) | HRA 24% (X Class Cities) |

| 1 | Rs. 18000 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 2 | Rs. 18500 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 3 | Rs. 19100 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 4 | Rs. 19700 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 5 | Rs. 20300 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 6 | Rs. 20900 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 7 | Rs. 21500 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 8 | Rs. 22100 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

HRA Rates for Pay Matrix Level 2

| 7th Pay Commission Pay Matrix Level 2 (Grade Pay 1900) | ||||

| Index | Basic Pay | HRA 8% (Z Class Cities) | HRA 16% (Y Class Cities) | HRA 24% (X Class Cities) |

| 1 | Rs. 19900 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 2 | Rs. 20500 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 3 | Rs. 21100 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 4 | Rs. 21700 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 5 | Rs. 22400 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

HRA Rates for Pay Matrix Level 3

| 7th Pay Commission Pay Matrix Level 3 (Grade Pay 2000) | ||||

| Index | Basic Pay | HRA 8% (Z Class Cities) | HRA 16% (Y Class Cities) | HRA 24% (X Class Cities) |

| 1 | Rs. 21700 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 2 | Rs. 22400 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

Important Links:

- 7th Pay Matrix Level 6 Hand Salary 35400

- Level 4 Pay Matrix 25500 in Hand Salary

- Expected DA Calculator from January 2023

- 7th Pay Commission Salary Calculator

- Go to Home Page

What is the HRA for government employees in India?

The HRA for government employees in India is an allowance provided to them by their employers for meeting their housing expenses.

What does the 7th Pay Commission New HRA Table cover?

The 7th Pay Commission New HRA Table covers the standard HRA rates applicable to different city classifications and different levels of salaries.

How is the HRA Exemption from Income Tax calculated?

The HRA Exemption from Income Tax is calculated on the basis of basic salary, city of residence and the rate of HRA received.

How are cities classified for HRA after 7th CPC?

Cities are classified into three categories- X, Y and Z. The rate of HRA applicable to each category is different.