7th Pay Commission Salary Calculator Tool 2023

In general, basic salaries of central government employees are accompanied by additional benefits. However, workers in the industrial sector may also be entitled to specific allowances such as the Night Duty Allowance for those who work late shifts. Regardless of their job roles, all officials and staff members of the central government receive basic grants, which include Dearness Allowance, Transport Allowance, and House Rent Allowance. These allowances are calculated based on their respective basic salaries. This text rephrasing tool is designed to generate outcomes based on an individual’s basic pay.

| Subject | Salary Calculator |

| Beneficiaries | Central Govt Employees |

| Method | As per the 7th CPC |

| Implemented From | 1.1.2016 |

| Pay Structure | Pay Matrix Level & Basic Pay |

| Modified on | 31.03.2023 |

| DA Rate | 42% |

| Allowances | As per existing rates |

Basic Salary Calculator for CG Employees

The Indian Government has a resource available to Central Government workers who want access to information about their monthly salaries. This resource is designed to provide an understanding of the compensation that employees receive for the current month. The government operates Central Government locations in various regions of India, including cities, towns, and rural areas. It’s important to note that the salary package may vary depending on the location of the workplace, with differences observed between rural and metropolitan areas. To simplify salary calculations, an easy-to-use online tool is available free of charge. By entering the basic salary and allowances, Central Government employees can use this tool to assess their compensation package effortlessly.

Pay Matrix Level and Basic Pay

In January 2016, Central government employees were given a new pay structure as a result of the implementation of the 7th pay commission. To enhance transparency in the pay progression, a PAY MATRIX table was utilized. This table is composed of two dimensions, namely the horizontal hierarchy and vertical basic pay progression which has 40 different stages. The table specifies that the minimum basic pay level is at Level 1 and amounts to Rs. 18000. To assist with this, an online tool was created that follows the same pattern as the Pay Matrix Table. By using this tool, users can choose their Pay Matrix Level and corresponding basic salary, and the results will be displayed instantly.

Related Topics:

- Cabinet approves 4% DA to CG Employees and pensioners from Jan 2023

- TN CM MK Stalin Announces 4% DA Hike for TN Govt Employees and Teachers from 1.1.2023

- DA/DR from January 2023 at 42% is Confirmed

42% DA Gross Salary Calculator 2023

The recently developed DA Gross Salary Calculator has been approved by the Cabinet for Central Government workers. Starting from 1st January 2023, this revised package will increase their salary by 42%, elevating their take-home pay. Employees can use an online tool to know their pay package. By providing basic salary and pay matrix level, the tool will calculate applicable allowances and monthly salary instantly.

Allowances Paid to Central Govt Employees

The Central Government provides a range of allowances for its employees, such as HRA, Transport Allowance, and Dearness Allowance. These benefits are typically determined by factors such as job duties, deployment location, and job rank. In 2016, the 7th Pay Commission reviewed these allowances and instituted recommendations that went into effect on January 1st of that year. Additionally, a panel was established to evaluate the recommendations regarding allowances, resulted in some modifications or eliminations of specific benefits. Some notable examples of benefits available to Central Government Employees are Children Education Allowance, Leave Travel Concession, and Non-Practicing Allowance.

Gross and Take Home Salary Calculation

The Central government determines the gross salary by combining the basic pay, dearness allowance, house rent allowance, transport allowance, and other supplementary allowances. The take-home salary, on the other hand, pertains to the remaining amount after compulsory government and private deductions have been removed from the overall salary.

Important Deductions of Central Govt Employees

There are numerous deductions available for income tax purposes that occur annually or monthly. One of these deductions is the TDS, while another is the CGEGIS subscription amount that is dependent on pay level. Additionally, there is a mandatory deduction for either the Provident Fund or NPS. If a loan is taken out for things such as medical expenses, festivals, a computer advance, or an HBA, there will be a deduction made for monthly installment payments. Lastly, the pay slip will include deductions for monthly charges such as the government quarters’ license fee and HRA.

Salary Calculation on Classification of Cities

When determining an employee’s pay, the location of their office is a significant factor. The salary is determined based on whether the office is located in a city, urban, or rural area. Companies in both the private and public sectors tend to allocate a specific percentage of the basic salary towards housing expenses, which is known as the Housing Rent Allowance (HRA). The percentage assigned to HRA varies depending on the classification of the city or town. The HRA amount is then calculated based on the basic salary of an employee, with different percentages ranging from 27% to 9% based on the categorization of the city or town. Thus, if an employee earns a basic salary of Rs. 49,000, the HRA amount will either be Rs. 13,230, Rs. 8,820, or Rs. 4,410 based on the percentage applied.

How to Use the Salary Calculator

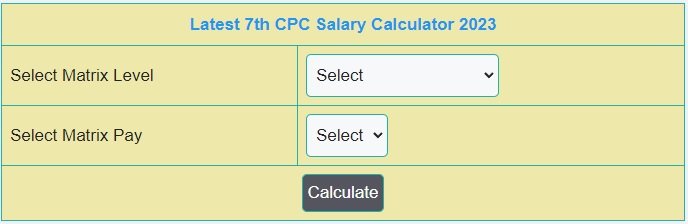

The TEUT Calculator provides a selection for Pay Matrix level and a dropdown list for basic salary. In order to use the tool, users must select their Pay Matrix level and Basic Pay, then proceed to click the submit button. The tool will then generate a comprehensive summary of the salary package split into four sections based on the categorization of cities and towns for House Rent Allowance and Transport Allowance.

Important Links:

- 7th Pay Matrix Level 6 Hand Salary 35400

- Level 4 Pay Matrix 25500 in Hand Salary

- Expected DA Calculator from January 2023

- 7th Pay Commission Salary Calculator

- Go to Home Page

Is the 7th Pay Commission Salary Calculator 2023 reliable?

Yes, the 7th Pay Commission Salary Calculator 2023 is designed to provide you with accurate and up-to-date salary information for central government employees.

What is the 7th Pay Commission Salary Calculator 2023?

The 7th Pay Commission Salary Calculator 2023 is a software that helps central government employees calculate their gross and take home salary, allowances, and important deductions based on the classification of cities.

How can I use the 7th Pay Commission Salary Calculator 2023?

The 7th Pay Commission Salary Calculator 2023 is easy to use and can be accessed online. Simply enter your information such as your salary and any applicable deductions to get a detailed salary calculation.